VPPs connect home batteries to the energy grid to create a powerful network that saves homeowners money, supports clean energy and helps prevent outages.

-

En español

-

Pay bill

Please verify your service location to access this:

-

Contact us

Please verify your service location to access this:

-

Electricity & gas

Choose Direct Energy

Direct Energy is dedicated to helping you choose the right energy solutions for your unique needs. Find the perfect fit with our electricity and natural gas plans today.

-

Home solutions

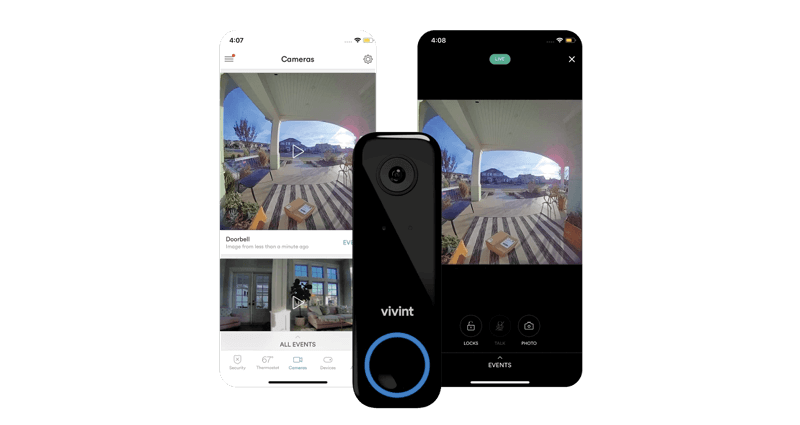

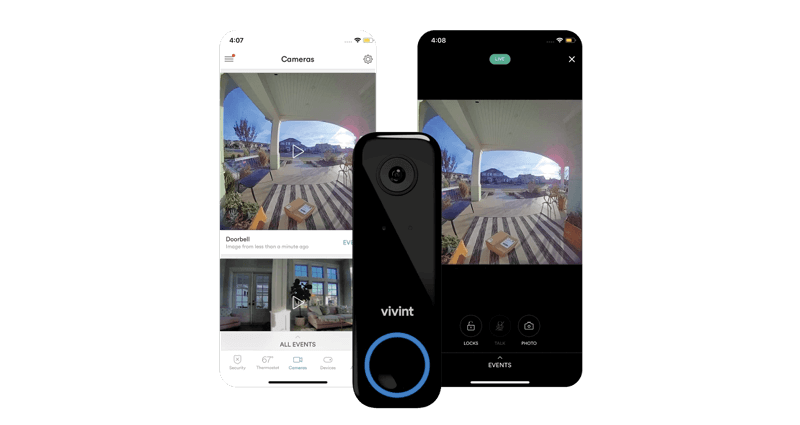

A smarter, safer home

Home security, automation and efficiency at your fingertips. Protect your peace of mind with an exclusive offer from our partner Vivint.

-

Learning center

25 energy-efficient tips for lower electricity costs

Discover practical, energy-saving tips to reduce electricity costs and increase efficiency at home or business. Knowledge is power, literally!

-

Support

Download the app

Get the Direct Energy app to easily pay your bill, manage your account, keep an eye on your usage, refer friends and more.

Choose Direct Energy

Direct Energy is dedicated to helping you choose the right energy solutions for your unique needs. Find the perfect fit with our electricity and natural gas plans today.

A smarter, safer home

Home security, automation and efficiency at your fingertips. Protect your peace of mind with an exclusive offer from our partner Vivint.

25 energy-efficient tips for lower electricity costs

Discover practical, energy-saving tips to reduce electricity costs and increase efficiency at home or business. Knowledge is power, literally!

Download the app

Get the Direct Energy app to easily pay your bill, manage your account, keep an eye on your usage, refer friends and more.

Please verify your service location to access this: